swipesmart

TF Select

Hi,

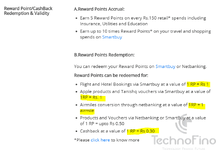

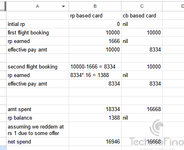

I was looking smartbuy which gives 16.5% as reward points considering 5X vouchers. But this 16.5% is not actually 16.5% monetary value right unless used at Tanishq or Apple right ?

Because other good option is to transfer miles and Accorr was most rewarding but now with Accorr it's 1 RP points = 0.5 Accor points.

I do agree that we have other airlines/hotel partner where it's still 1:1.

Can someone help me or I'm missing something

I was looking smartbuy which gives 16.5% as reward points considering 5X vouchers. But this 16.5% is not actually 16.5% monetary value right unless used at Tanishq or Apple right ?

Because other good option is to transfer miles and Accorr was most rewarding but now with Accorr it's 1 RP points = 0.5 Accor points.

I do agree that we have other airlines/hotel partner where it's still 1:1.

Can someone help me or I'm missing something