iScore by ICICI

This discussion is to understand what is an iScore by ICICI which appears in iMobile App under " Discove" tab for SB account holders

its impact on pre-approved offers and their limits..

This discussion is to understand what is an iScore by ICICI which appears in iMobile App under " Discove" tab for SB account holders

its impact on pre-approved offers and their limits..

What is iScore?

iScore is an internal/proprietary score score provided by ICICI Bank to its customers, on the basis of their transactions in the physical and digital world.

Before we go on to the details of how it is calculated , let us see its uses from customer perspective based on my observations:

1) iScore - its impact on Credit card pre approved offers

( Very minor role as of now, but could play a considerable role in future)..

iScore is not playing a siginificatnt role in triggering pre-approved credit card offers yet.. but in future it may be considered with some greate importance depending upon how ICICI wants to take this forward ..

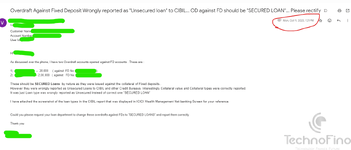

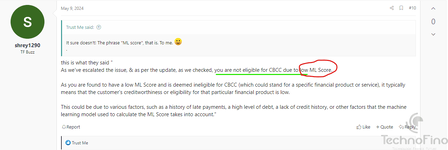

I found only one instance where low iScore had resulted in no pre-approved offers for a customer.. ..in the following case..

complete details are here in this thread..

What it essentially means, iScore is playing some part in triggering pre-approved CC offers , albiet a very minor role as of now..

pre approved offer

So do u guys know how do i get pre-approved offer in hdfc. My situation right now is: 1) I have an fd backed icici instant platinum credit card with 45k limit 2)I am 19 yrs old 3)civil of 760, Experian of 764 the issue here is my age as I believe no bank gives card to under 21. So I don't have...

2) Significant role in Crdit limits on products like Credit card, Home Loan, Personal Loan , Auto loan etc.

This is where the plot thickens.. I have found quite a significant co-relation between iScore and limits offered on various Credit / Loan products ..

The higher the iScore the higher the limits offered.....

3) Essentially iScore is useful for limits offered on differnt pre-approved loans largely and to credit card limits to some extent ...

Now.. We will go into the academics of iScore,

What is an iScore, how it is built, how to improve, what are the different slabs, etc..

Here I am providing allt he screenshots of these FAQ's taken directly from iMobile App...

It is quite easy to understand...

Some basic details of iSocre..

1) This is available under " Discover " tab in iMobile app.

2) The customer had to hold a SB account to see thid option

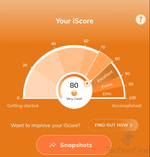

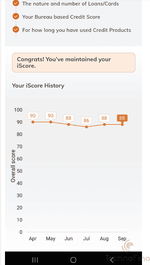

3) In the first screen it will show your score..

4) You will find a button there to find out " how to improve your iScore?" .. these options are customized according to the cutomer's current profile..

Basically they want us to use thier different ICICI products..

Tip: Try to use as many products as possible with the least amount of cashoutflow.. the trick is we need to use different prodcuts offerd by ICICI and make sure they are not forced spending on our part. and still try to cover maxmium products with least amuont of outflow..

for eg. regularly we can use some token pre-paid recharge ( load Rs10 into mobile's main balance), a few payments thru QR scan etc...

This way I kept my iScore at 90 at one point of time...

Like this you can find your own spend types..

You can find your iScore( for SBA holders) under " Discover " in iMobile App..

Scroll down to the bottom in the " Discover" tab.

Now FAQ's part

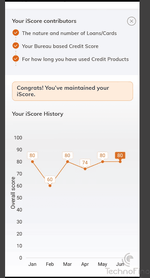

My Old iScore Screeshot: found in this thread..

ICICI MOBILE iscore

Anyone using ICICI 10k account or zero amb account. How to increase I score .any suggestions

My Pre-approved credit limits offered on different loans based on my

1) 24L income recorded as per ICICI records

2) current iScore of 80, ( before 90)

1. Home Loan : 95L

2. Auto Loan : 50L

3. Two Wheeler Loan: 4.10 L

4.Loan against Property : 80L

5. Loan against comeercial property: 80L

Now, Let us do some collobarative research on this topic to establish some facts based on my above observations...

Share your profile, iScore, your pre approved offers, its limits etc.. your expereince and observations ..

I believe , this will definitely help in understanding how ICICI triggers its pre-approved offers and limits going into the future...

Imprtant Note: If you have very high income (ITR) and a very good CIBIL, and have availed decent amount of credit products from ICICI, then iScore's role is negligible in your pre-approved Credit card offers.. Actually some of these factors will contirbute to the high iScore itself and there by good offers...

Last edited by a moderator: