Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Need advice on where to invest 8.75lakh for guaranteed high returns

- Thread starter the_dark_knight

- Start date

- Replies 230

- Views 14K

I don't think they allow restructuringInteresting.. Is there any formula to convert fixed rate to reducing rate?

Reducing rate will be higher and the fixed rate will be always lower. We generally mean "flat interest rate" when we use the term interest rate. There is some formula yes but I too haven't gone into the depths of it to understand completely.Interesting.. Is there any formula to convert fixed rate to reducing rate?

Mine was a reducing interest rate kinda loan only, and hence every month emi will be little different also interest amnt in every emi will decrease every month.I don't think they allow restructuring

There is nothing like restructuring or choosing between flat and reducing rate.

When i said i took the loan at 7%, its basically means effectively it is at a flat interest rate of 7% , in total i paid to bank (principal + 7% on principal, by the end of 1 yr)

So it's just simple interest, right? Since it is 1 year 7% of 8.75L is the interest??Reducing rate will be higher and the fixed rate will be always lower. We generally mean "flat interest rate" when we use the term interest rate. There is some formula yes but I too haven't gone into the depths of it to understand completely.

yeah you can say so, because i took the tenure as 1 yr, so by calculations it is a simple interest flat rate of 7%So it's just simple interest, right? Since it is 1 year 7% of 8.75L is the interest??

AritraSaha

TF Prestige

Get a another dc.. open a another account..already using that but this capping will get exhaust now, so need some other way for remaining bill payment every month (around 50k)

Yeah thought so, amortization may be different. Anyway, check whether you can use Amazon Pay credit card itself heavily for friends and family to get 5% cashback to bridge the interest 😀Mine was a reducing interest rate kinda loan, and hence every month emi will be little different also interest amnt will decrease every month.

When i said i took the loan at 7%, its bascially means effectively it is at a flat inetrest rate of 7% , in total i paid to bank (principal + 7% on principal, for 1 yr)

Yeah that is one route anyway.Get a another dc.. open a another account..

But I was thinking guys here would have find some way to generate even 2% returns on cc bill payments considering one has to pay 75k regularly for 1 year.. like any debit card where one can get cashback 1% approx or more and in addition to that some milestone voucher rewards as well

Rbl signature debit cardYeah that is one route anyway.

But I was thinking guys here would have find some way to generate even 2% returns on cc bill payments considering one has to pay 75k regularly for 1 year.. like any debit card where one can get cashback 1% approx or more and in addition to that some milestone voucher rewards as well

yeaah was waiting for some1 to suggest this only.... can you direct me to this card's thread where dada has explained all its featuresRbl signature debit card

@Abhishek012 can elaborate on thiayeaah was waiting for some1 to suggest this only.... can you direct me to this card's thread where dada has explained all its features

Never ever invest in MF or Stocks with borrowed money. Doesn't matter even if it can offer 30% returns.

Moreover, you are not allowed to invest using loans. As the IT department now uses Big Data, they can track everything easily.

Also, remember, you have got a loan at 11% RRR and you are in 30% Tax Bracket.

Avoid P2P. Might look good now, if it gets focked, no one can get your money back.

Safest is Tax Saving FD in Senior citizen name or Treasury T-Bills.

Moreover, you are not allowed to invest using loans. As the IT department now uses Big Data, they can track everything easily.

Also, remember, you have got a loan at 11% RRR and you are in 30% Tax Bracket.

Avoid P2P. Might look good now, if it gets focked, no one can get your money back.

Safest is Tax Saving FD in Senior citizen name or Treasury T-Bills.

Moreover, you are not allowed to invest using loans --- can you site some official docs for this. Investment as in, are fd investments not allowed too?Never ever invest in MF or Stocks with borrowed money. Doesn't matter even if it can offer 30% returns.

Moreover, you are not allowed to invest using loans. As the IT department now uses Big Data, they can track everything easily.

Also, remember, you have got a loan at 11% RRR and you are in 30% Tax Bracket.

Avoid P2P. Might look good now, if it gets focked, no one can get your money back.

Safest is Tax Saving FD in Senior citizen name or Treasury T-Bills.

yesDid ICICI call you and offer this loan ?

3 words

nice article...thanks.

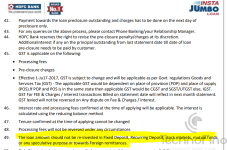

but isnt it hdfc bank who is saying this as per their internal policy?

It was also visible in ibanking app from a long time. although on the app processing fee was reflecting and interest rate was slightly higher too. But on call, they reduce the criteriaDid ICICI call you and offer this loan ?

In rbl signature+ card, can we achieve 2% return on cc bill payment, considering we hit the 5lac yearly milestone?Rbl signature debit card

ACC to my opinion, it should give 2% cashback overall, but then why would everyone promote the hdfc's easyshop platinum or millenia debit card, which gives 1% max only?

I am surprised here, am I missing any t&c or anything abt rbl debit card?

@Abhishek012 @D₹V @xywowowvw @thanix

Last edited:

Similar threads

- Replies

- 2

- Views

- 125

- Replies

- 1

- Views

- 404

- Replies

- 2

- Views

- 685

- Question

- Replies

- 19

- Views

- 1K

- Suggestion

- Replies

- 18

- Views

- 685