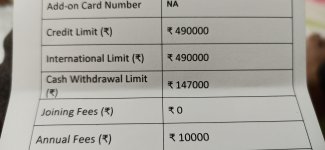

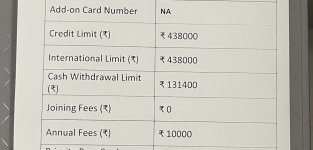

I received Axis Magnus card today and with that paper mentioning card number and fees.

I see that joining fee is mentioned 0 and annual fees is 10k. Does it mean joining fee is waived off for me? Check pic for reference.

Anyone got similar offer?

I see that joining fee is mentioned 0 and annual fees is 10k. Does it mean joining fee is waived off for me? Check pic for reference.

Anyone got similar offer?