Hello 🤗

I know there are already many threads on same topic, so I won't bore you anymore. Kya matlab sirf badge badhane ke liye post kara hai😭 🤣

Let's get straight to the point ☝🏻

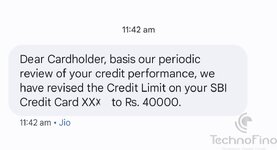

Starter - Limit got reduced by half.

86k to 40k

Main course --

1. I recently got it converted to LTF

2. Card is purely 13 months old only.

3. Got approved for prime earlier, but downgraded to Simply Click (ifykyk)

4. I am not fulfilling any of the criteria mentioned by @TechnoFino for decrease in credit limit.

4.1 No change in my CIBIL score from last 90 days

4.2 No new cards/loan issued in past 6 months. So, no over leverage also**

4.3 Delay - Wo kya hota hai

4.4 No financial problem in IND🇮🇳 as of 10th May 2024🙏🏻

4.5 Misuse - Hai kya SimplyClick me misuse krne ko 🤡

My query is - Has anyone got their limit re-instated after this fiasco, if yes "bata de bhai, dua milegi"

*Already sent a dhamki mail💌

I know there are already many threads on same topic, so I won't bore you anymore. Kya matlab sirf badge badhane ke liye post kara hai😭 🤣

Let's get straight to the point ☝🏻

Starter - Limit got reduced by half.

86k to 40k

Main course --

1. I recently got it converted to LTF

2. Card is purely 13 months old only.

3. Got approved for prime earlier, but downgraded to Simply Click (ifykyk)

4. I am not fulfilling any of the criteria mentioned by @TechnoFino for decrease in credit limit.

4.1 No change in my CIBIL score from last 90 days

4.2 No new cards/loan issued in past 6 months. So, no over leverage also**

4.3 Delay - Wo kya hota hai

4.4 No financial problem in IND🇮🇳 as of 10th May 2024🙏🏻

4.5 Misuse - Hai kya SimplyClick me misuse krne ko 🤡

My query is - Has anyone got their limit re-instated after this fiasco, if yes "bata de bhai, dua milegi"

*Already sent a dhamki mail💌