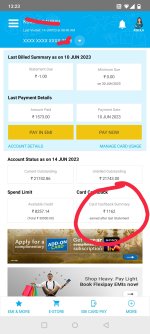

Bad news for SBI Cashback card Travel spend Reported MCC 4112 (no cashback on this MCC):

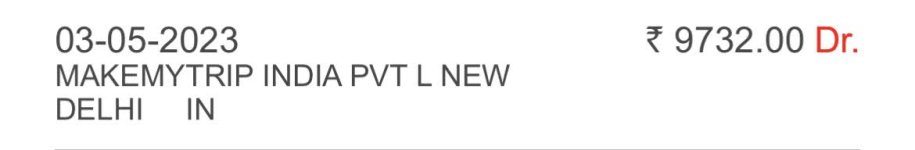

MCC 4112 is Railway category.When we book Airline tickets on Cleartrip, Makemytrip, Yatra, Easymytrip websites/app. These merchant transactions reported MCC is 4112 and we will not get any cashback.

Please share other travel booking website, where you get cashback on airline tickets using SBI Cashback credit card.

5% Cashback eligible merchants list for flight bookings, shared by other users -

1) For flight booking on Agoda, got 5% cashback (Category - Lodging)

2) Booking on tataneu/airasia got the 5% cashback

3) i got for happyfares

4) Got cashback on Paytm flight booking

5) Intermiles

6) one person shared this - Booked flight tickets on Yatra website. Used Amazon pay payment gateway and paid via sbi cashback cc. Got 5%.

Last edited: