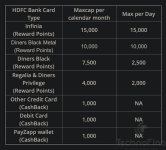

Hmm, HDFC looks set to introduce a metal version of DCB that raises the daily and monthly cap of the current PVC DCB.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

And I also got the same auto upgrade offer to DCB Metal FYF, but I went for Infinia upgrade via RM and got it approved.Got RM to get me DCB (plastic) FYF upgrade from Regalia in August. Then contacted Infinia Services in October for upgrade to Infinia Metal and got refused. Had justified upgrade by citing 14.50 lakhs spends in 12 months and poor international acceptance of DCB (Thailand and Singapore). I guess I wrote too soon...maybe I should've used DCB for 6 months. Escalated to Grievance Redressal, Priority Redressal and PNO but still got refused so I let it pass.

Last week got an automatic offer to upgrade to DCB Metal FYF and immediately accepted even though my plastic DCB fees were already waived for 2024-25 due to spends. My logic is it brings me another step closer to Infinia. I can re-coup a few grand on Smartbuy higher capping and hopefully the annual fees by hitting 4 lakhs / quarter at least once or 8 lakhs / year. As someone pointed out, it is better to not feel entitled and slowly inch closer at every opportunity.

As for the card itself, it feels solid in the hand like Infinia unlike Magnus. In fact, Magnus feels like plastic when held alongside.

Is this cooling period in their internal guidelines or just a hunch based on various cardholders' experience? I got overconfident having had such high spends and impatience kicked in as well.After every upgrade, there is a cooling period of no less than 6 months. If you had waited for couple of more months and had 8L spend in the last 6 months, you could have upgraded directly to Infinia. That said, DCB metal is also good, but it resets the cooling period.

It is definitely there in their internal policy, which they will not reveal. They will never admit it through the official channels similar to the spending criteria (xx in 6 months) or other criteria which is not public. You can extract these information from your RM, who generally talk in the back channels with the CC team.Is this cooling period in their internal guidelines or just a hunch based on various cardholders' experience? I got overconfident having had such high spends and impatience kicked in as well.

It’s the policy actually. Nevertheless there’s a solution. Since you meet the spends and the limit already you’ll need a product level approval as far as I know. Talk to your RM and ask to seek the same through product.Is this cooling period in their internal guidelines or just a hunch based on various cardholders' experience? I got overconfident having had such high spends and impatience kicked in as well.

Pardon my ignorance, but what do you mean by product level approval?It’s the policy actually. Nevertheless there’s a solution. Since you meet the spends and the limit already you’ll need a product level approval as far as I know. Talk to your RM and ask to seek the same through product.

Branch banking head approval also not reqd , straight away product level approval is enough.Product level approval :

- You are currently using DCB so DCB is managed by a product manager who looks after diners acquisitions and product pool ( number of customers etc ), so giving you an infinia means letting you go from the existing diners pool for which the product manager who owns diners network at hdfc needs to approve . This is product level approval.

- RM is useless : This is a universal problem. This is where you need to talk to minimum of cluster head or a circle head to F**k RMs happiness. Their email IDs will be at the branch.

- 6 months period : Usually policy doesn’t allow an upgrade in < 6 months that’s where you need to seek an exception. Branch banking head approval will supersede this and get you an infinia. Product level approval will be managed by the CC team that’s a small thing.

So how do I straight away request for product level approval if not through branch head?Branch banking head approval also not reqd , straight away product level approval is enough.

You cannot. Product won’t handle CRM, talk to branch banking leadership. Alternatively kindly DM, let’s check this.So how do I straight away request for product level approval if not through branch head?

You cannot. Product won’t handle CRM, talk to branch banking leadership. Alternatively kindly DM, let’s check this.

I got confused with these 2 contradictory replies.Branch banking head approval also not reqd , straight away product level approval is enough.

I got confused with these 2 contradictory replies.

Finally placed savings/salary account closure request 😅.Obviously I looked from that angle and that's why I took the paid infinia card over LTF DCB.

But I won't continue savings/salary account, as they didn't give extra benefits.

What benefits you were expecting?Finally placed savings/salary account closure request 😅.

Read the previous mail chain.What benefits you were expecting?

Ltf Infinia ?

From my conversation with customer care it does count. But no personal experience. Please confirmwill exclusion list such as wallet transaction, government transaction , Fuel Spends part of milestone threshold calculation of 4Lakh quarterly in DCB Metal ?

Yeah they do are a part of threshold calculation. However there won't be any reward points as they are a part of exclusion merchant categorieswill exclusion list such as wallet transaction, government transaction , Fuel Spends part of milestone threshold calculation of 4Lakh quarterly in DCB Metal ?

Thanks for confirmingYeah they do are a part of threshold calculation. However there won't be any reward points as they are a part of exclusion merchant categories