Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How to get SC credit card?

- Thread starter tushu5121

- Start date

- Replies 117

- Views 10K

Pack_of_Cards

TF Premier

This is the best method for SC cards. 1Re otp verification transaction on existing SC card and based on limit they upgrade card. You can do it on next day itself.

You said you received titanium why going for a lower end card, you said limit is 5L go for Ultimate.

Click 'Apply Now' -> Select 'Yes' as existing customer -> Enter existing card details and pay Rs. 1 -> Done. Your new card will be approved and dispatched.

You said you received titanium why going for a lower end card, you said limit is 5L go for Ultimate.

I applied for Smartcard.

Last edited:

I didn't want to upgrade. I was hoping to keep both my current Titanium card and get a new Smartcard.This is the best method for SC cards. 1Re transaction and based on limit they upgrade card you can do it on next day itself.

You said you received titanium why going for a lower end card, you said limit is 5L go for Ultimate.

Pack_of_Cards

TF Premier

I guess then it is fine. Good thing is AFAIK they will let you keep 2 cards.I didn't want to upgrade. I was hoping to keep both my current Titanium card and get a new Smartcard.

Done . .Can you share the details

I guess then it is fine. Good thing is AFAIK they will let you keep 2 cards.

and its single entry in CIBIL for all SC cards.

How many cards can one get from SC?

all but some cards required some limit in existing SC card.

Note: Things may vary from person to person based on existing card, earlier spend pattern etc. best case all can be obtained.

Curious to know which cards you considered? because with annual fee, benefits, and reward options SC has limited useful credit cards.

Do you mean the message that says your email has been updated?

its actually 'your card approved and will be delivered in x days', but if you changed email, address etc. you'll get those mails too. Basically if you get any of these mails otherthan rejected, its approved. You can login SC netbanking and see card details, if available.

I had EMT since last year, requested for Ultimate but as limit was <3L, they offered Smart, so I took it few months back. Not sure when Ill get LE to get hold of Ultimate.. not interested in any other card though. Do you know if we can do C2C even if we are ETB?all but some cards required some limit in existing SC card.

Note: Things may vary from person to person based on existing card, earlier spend pattern etc. best case all can be obtained.

Curious to know which cards you considered? because with annual fee, benefits, and reward options SC has limited useful credit cards.

I had EMT since last year, requested for Ultimate but as limit was <3L, they offered Smart, so I took it few months back. Not sure when Ill get LE to get hold of Ultimate.. not interested in any other card though. Do you know if we can do C2C even if we are ETB?

Before that did you checked 360 reward portal and verified avaible vouchers, did you find any of them useful? because with Ultimate spends, you have to redeem on those vouchers only.

No idea, C2C when ETB. Maybe check with @deep@vie , not sure.

Agree, I believe they will bring back some useful ones, otherwise everyone will close their rewards based cards. 🙂Before that did you checked 360 reward portal and verified avaible vouchers, did you find any of them useful? because with Ultimate spends, you have to redeem on those vouchers only.

No idea, C2C when ETB. Maybe check with @deep@vie , not sure.

Agree, I believe they will bring back some useful ones, otherwise everyone will close their rewards based cards. 🙂

Good luck with that, I completed 2 years by thinking same and I have to redeem this year no matter otherwise points will expire.

Only purpose of taking it would be to use for payments where all cards are having exclusionsGood luck with that, I completed 2 years by thinking same and I have to redeem this year no matter otherwise points will expire.

Not possible without reaching 4l limit.I had EMT since last year, requested for Ultimate but as limit was <3L, they offered Smart, so I took it few months back. Not sure when Ill get LE to get hold of Ultimate.. not interested in any other card though. Do you know if we can do C2C even if we are ETB?

Other thing can be done is cancelling SCB cad & trying with existing 5l card.

SCB has stopped Ultimate form channel partners so need to approach the bank directly for that.

What is a good card from SC which considers govt transactions for rewards?Not possible without reaching 4l limit.

Other thing can be done is cancelling SCB cad & trying with existing 5l card.

SCB has stopped Ultimate form channel partners so need to approach the bank directly for that.

Is there any good card to hold from SC other than Ultimate and I can safely pass this SC cards?

Any SC specialists can throw some light here?? Thanks

Only purpose of taking it would be to use for payments where all cards are having exclusions

Ok. but you're forgetting that if you do not like or use any of these vouchers - you're not getting anything like exclusions in other cards. Lastly, consider reward rate as 2.5% like that because

1. you may not need these vouchers at all

2. even if you need, can get at 10% discount in other platforms

3. even all these you have to pay annual fee and redemption fee

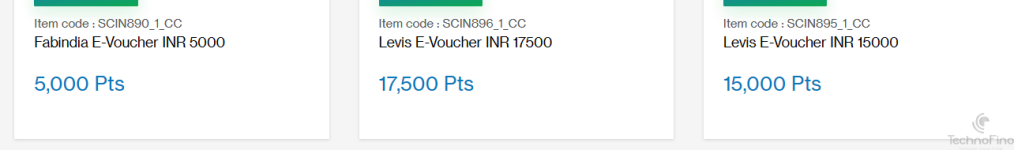

Ex: You may think you're getting 3.33% reward on some exclusion categories and acquired 20K points (by spending 6L it need), you may have these options only

what good it serve you by paying that convinience fee etc. in those exclusion categories websites, where you can obtain these vouchers at 10%+ in other markets (even in the first place, you may not need it).

What is a good card from SC which considers govt transactions for rewards?

Is there any good card to hold from SC other than Ultimate and I can safely pass this SC cards?

Any SC specialists can throw some light here?? Thanks

SC Smart for now. Ignore all reward cards.

Totally agree with you, if the redemption options are not worthwhile, even if we get 5% back..it's not worthOk. but you're forgetting that if you do not like or use any of these vouchers - you're not getting anything like exclusions in other cards. Lastly, consider reward rate as 2.5% like that because

1. you may not need these vouchers at all

2. even if you need, can get at 10% discount in other platforms

3. even all these you have to pay annual fee and redemption fee

Ex: You may think you're getting 3.33% reward on some exclusion categories and acquired 20K points (by spending 6L it need), you may have these options only

View attachment 36001

what good it serve you by paying that convinience fee etc. in those exclusion categories websites, where you can obtain these vouchers at 10%+ in other markets (even in the first place, you may not need it).

It's like HDFC swiggy card..

I too thought so, thanks for confirmation.SC Smart for now. Ignore all reward cards.

Does this include govt transactions?

I too thought so, thanks for confirmation.

Does this include govt transactions?

for now yes, not sure about tomorrow 😀

But the main issue with this card is about Capping..for now yes, not sure about tomorrow 😀

Similar threads

- Question

- Replies

- 15

- Views

- 2K

- Replies

- 7

- Views

- 230

- Replies

- 8

- Views

- 438

- Question

- Replies

- 3

- Views

- 240