iamabhisekagar

TF Legend

Hi,

Recently, I acquired an LTF Tata Neu Plus CC. Now I generally use Cred for making my credit card bill payments.

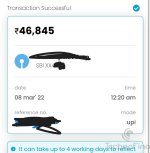

So, when its first bill of Rs 2630 was generated on 1 June 2023, I used Cred to pay the bill on 17th June 2023 (Saturday).

However, the amount was not credited as of 19th June 2023 (Monday). I became sceptical and made another payment of Rs 10 to check whether it was getting settled or not and it didn't.

On the 20th I contacted Cred via Twitter:

I received a call from Cred Customer Service the same day. He asked me whether Rs 1 was credited to the card when I added the card details to the Cred app for the first time. I checked and found that I had not received Rs 1 for the same. Now Since Tokenisation got implemented, the Cred Customer Service guy was unable to tell me what Card number I had entered in the app.

So, he asked me to remove the said card and add that card again to verify whether the card removed and the card added were the same or different. I did the same, and he informed me that I had paid the amount to the wrong credit card number.

Now, generally whenever you make a transaction, a UTR (Unique Transaction Reference) is attached to it. For better understanding kindly refer to the link:

www.idfcfirstbank.com

www.idfcfirstbank.com

Whenever you use Cred to make a Credit Card bill payment. The amount that you pay is transferred to Cred's Bank Account. And then Cred Transfers the amount from its Bank account to the Credit Card. Hence, a single bill payment via Cred is a 2 transaction affair.

So, The Customer Service guy provided me with the UTR numbers for the payment of Rs 2630 and Rs 10 they made to the wrong card and asked me to contact bank (HDFC in my case).:

So, I drafted an email and sent it to pnohdfcbank@hdfcbank.com providing the necessary details:

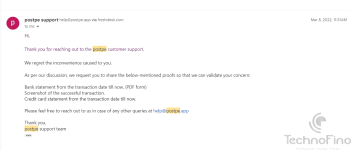

The next day I received a call from the Bank, I explained the entire situation to them and they registered a service request. A few days later, I received the following mail from the bank in which they confirmed that the payment went to an invalid Card number and it shall be reversed in 7-10 days.

As explained above, the reversal of the payment by the Bank will get credited to Cred's bank Account. So, again I contacted Cred via Twitter and provided them with the screenshot of the above mail.

3 days later, Cred Customer Service called again and asked me to obtain the following from Bank:

1. last 4 digits of the acc no

2. reversal date

3. Amount

4. Reversal UTR number

I again emailed the Bank asking for the same

:

On July 4th, the bank provided me with the details which I forwarded to Cred via Twitter as well as via Email.

On July 5th, Cred reversed Rs 2630 and Rs 10 to my bank account.

Recently, I acquired an LTF Tata Neu Plus CC. Now I generally use Cred for making my credit card bill payments.

So, when its first bill of Rs 2630 was generated on 1 June 2023, I used Cred to pay the bill on 17th June 2023 (Saturday).

However, the amount was not credited as of 19th June 2023 (Monday). I became sceptical and made another payment of Rs 10 to check whether it was getting settled or not and it didn't.

On the 20th I contacted Cred via Twitter:

I received a call from Cred Customer Service the same day. He asked me whether Rs 1 was credited to the card when I added the card details to the Cred app for the first time. I checked and found that I had not received Rs 1 for the same. Now Since Tokenisation got implemented, the Cred Customer Service guy was unable to tell me what Card number I had entered in the app.

So, he asked me to remove the said card and add that card again to verify whether the card removed and the card added were the same or different. I did the same, and he informed me that I had paid the amount to the wrong credit card number.

Now, generally whenever you make a transaction, a UTR (Unique Transaction Reference) is attached to it. For better understanding kindly refer to the link:

What is a UTR Number and Where Can I Find It?

Learn about the Unique Transaction Reference (UTR) number. Discover what a UTR number is, its importance in financial transactions, and how to locate it on your bank statement.

Whenever you use Cred to make a Credit Card bill payment. The amount that you pay is transferred to Cred's Bank Account. And then Cred Transfers the amount from its Bank account to the Credit Card. Hence, a single bill payment via Cred is a 2 transaction affair.

So, The Customer Service guy provided me with the UTR numbers for the payment of Rs 2630 and Rs 10 they made to the wrong card and asked me to contact bank (HDFC in my case).:

So, I drafted an email and sent it to pnohdfcbank@hdfcbank.com providing the necessary details:

The next day I received a call from the Bank, I explained the entire situation to them and they registered a service request. A few days later, I received the following mail from the bank in which they confirmed that the payment went to an invalid Card number and it shall be reversed in 7-10 days.

As explained above, the reversal of the payment by the Bank will get credited to Cred's bank Account. So, again I contacted Cred via Twitter and provided them with the screenshot of the above mail.

3 days later, Cred Customer Service called again and asked me to obtain the following from Bank:

1. last 4 digits of the acc no

2. reversal date

3. Amount

4. Reversal UTR number

I again emailed the Bank asking for the same

:

On July 4th, the bank provided me with the details which I forwarded to Cred via Twitter as well as via Email.

On July 5th, Cred reversed Rs 2630 and Rs 10 to my bank account.