Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

IDFC First SWYP credit card launched

- Thread starter blaze

- Start date

Never heard this before but found below link. Seems to be an EMI credit card

www.idfcfirstbank.com

www.idfcfirstbank.com

Apply for FIRST SWYP EMI Credit Card Online | IDFC FIRST Bank

Get the FIRST SWYP Credit Card from IDFC FIRST Bank for unmatched rewards, flexible spending, and exclusive perks. Apply now by paying joining fees ₹499 + GST and instant approval.

Last edited:

blaze

TF Select

Hats off to your googling skill. God knows how you found this link.Never heard this before but found below link. Seems to be an EMI credit card

Apply for FIRST SWYP EMI Credit Card Online | IDFC FIRST Bank

Get the FIRST SWYP Credit Card from IDFC FIRST Bank for unmatched rewards, flexible spending, and exclusive perks. Apply now by paying joining fees ₹499 + GST and instant approval.www.idfcfirstbank.com

Haha kind of you but nothing special. I went to the view source of the normal credit card application page and it had swyp in hidden text and then from there it led to where it might be in the main site . Somehow Google isn't showing this link directly. Probably new launch and not indexed yet !Hats off to your googling skill. God knows how you found this link.

This card is a Pyramid Scheme.Never heard this before but found below link. Seems to be an EMI credit card

Apply for FIRST SWYP EMI Credit Card Online | IDFC FIRST Bank

Get the FIRST SWYP Credit Card from IDFC FIRST Bank for unmatched rewards, flexible spending, and exclusive perks. Apply now by paying joining fees ₹499 + GST and instant approval.www.idfcfirstbank.com

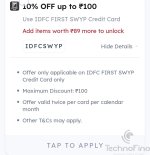

Yeah on zomato even I saw but thought must be chindi cc so didn't bother and it seem I was right.Just saw this offer on zomato. Any one has any info on this IDFC SWYP credit card?

Chethan_br

TF Buzz

IDFC First SWYP EMI credit card WITH a annual and renewal charges of 499 plus GST with flexible payment options and series of instant monthly discounts across

Dominos - 20%

Ease My Trip - 10%

Tata Cliq - 10%

Zomato - 10% and with

Joining benefits -

*1000 RP on first EMI conversion

*Lenkskart Gold Membership on joining

*Time Prime Membership on 30,000 spend with 90days

Milestone RP benefits -

*On monthly spends of ₹5000, ₹10,000 and ₹15,000

*UPI spends of ₹5000

And

*1% fuel surcharge waiver upto ₹200

*4 complimentary Railway Lounge Access per quarter

*25% discount on movie tickets upto ₹100

*Complimentary Road Assistance worth ₹1399

*Personal Accident cover of 2,00,000

And referral benefits and many more..

www.idfcfirstbank.com

www.idfcfirstbank.com

Dominos - 20%

Ease My Trip - 10%

Tata Cliq - 10%

Zomato - 10% and with

Joining benefits -

*1000 RP on first EMI conversion

*Lenkskart Gold Membership on joining

*Time Prime Membership on 30,000 spend with 90days

Milestone RP benefits -

*On monthly spends of ₹5000, ₹10,000 and ₹15,000

*UPI spends of ₹5000

And

*1% fuel surcharge waiver upto ₹200

*4 complimentary Railway Lounge Access per quarter

*25% discount on movie tickets upto ₹100

*Complimentary Road Assistance worth ₹1399

*Personal Accident cover of 2,00,000

And referral benefits and many more..

Apply for FIRST SWYP EMI Credit Card Online | IDFC FIRST Bank

Get the FIRST SWYP Credit Card from IDFC FIRST Bank for unmatched rewards, flexible spending, and exclusive perks. Apply now by paying joining fees ₹499 + GST and instant approval.

AritraSaha

TF Prestige

IDFC First SWYP EMI credit card WITH a annual and renewal charges of 499 plus GST with flexible payment options and series of instant monthly discounts across

Dominos - 20%

Ease My Trip - 10%

Tata Cliq - 10%

Zomato - 10% and with

Joining benefits -

*1000 RP on first EMI conversion

*Lenkskart Gold Membership on joining

*Time Prime Membership on 30,000 spend with 90days

Milestone RP benefits -

*On monthly spends of ₹5000, ₹10,000 and ₹15,000

*UPI spends of ₹5000

And

*1% fuel surcharge waiver upto ₹200

*4 complimentary Railway Lounge Access per quarter

*25% discount on movie tickets upto ₹100

*Complimentary Road Assistance worth ₹1399

*Personal Accident cover of 2,00,000

And referral benefits and many more..

Apply for FIRST SWYP EMI Credit Card Online | IDFC FIRST Bank

Get the FIRST SWYP Credit Card from IDFC FIRST Bank for unmatched rewards, flexible spending, and exclusive perks. Apply now by paying joining fees ₹499 + GST and instant approval.www.idfcfirstbank.com

isse ganda banane nahi mila kya kuch

IFDC has launched a new credit card - First Swyp

On the first look, the design looks very funky and modern and that's a good start in a market filled with dull cards.

What do you get with the card?

- ₹49 monthly conversion fee for turning your >₹2500 transactions into EMIs(no interest or other fees).

- TimesPrime annual membership on spending ₹30,000

- 4 Complimentary Railway Lounge Access

- 1% fuel surcharge waiver up to ₹200 p.m.

And it comes with a bunch of offers like:

- Dominos: 20% off up to ₹80 on orders above ₹299 twice in a month

- Easemytrip: 10% instant discount up to ₹500 on flight or hotel bookings above ₹5,000 once a quarter

- TataCLIQ: 10% instant discount up to ₹100 on purchases above ₹999 once on a month

- Zomato: Get 10% off up to ₹100 on orders above ₹299 twice in a month

You also get points for hitting monthly milestones,

200 reward points on 5k monthly spends.

500 reward points on 10k monthly spends.

1000 reward points on 15k monthly spends.

Annual fee: ₹499 + GST

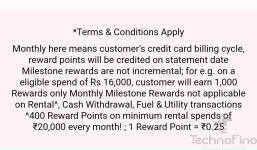

It's not free or LTF as users these days would expect from new entry-level cards but the bunch of offers and rewards it offers could be worth the price tag it comes with. There is an additional annual ₹199+GST charge for activating UPI on the card which has never been seen in any other cards. Also, UPI transactions won't count towards the milestones and the value of reward points is also uncertain but should get clear as more people start receiving it.

Also, there is no credit revolve feature which means you can't take the remaining balances on your card towards next month, you either pay in full or convert them into EMI which might people doubt if this even is a real card or another BNPL scheme in the making.

How will stand the stiff competition from the other banks and rising Rupay cards, we will have to wait and see.

What do you guys think about it?

On the first look, the design looks very funky and modern and that's a good start in a market filled with dull cards.

What do you get with the card?

- ₹49 monthly conversion fee for turning your >₹2500 transactions into EMIs(no interest or other fees).

- TimesPrime annual membership on spending ₹30,000

- 4 Complimentary Railway Lounge Access

- 1% fuel surcharge waiver up to ₹200 p.m.

And it comes with a bunch of offers like:

- Dominos: 20% off up to ₹80 on orders above ₹299 twice in a month

- Easemytrip: 10% instant discount up to ₹500 on flight or hotel bookings above ₹5,000 once a quarter

- TataCLIQ: 10% instant discount up to ₹100 on purchases above ₹999 once on a month

- Zomato: Get 10% off up to ₹100 on orders above ₹299 twice in a month

You also get points for hitting monthly milestones,

200 reward points on 5k monthly spends.

500 reward points on 10k monthly spends.

1000 reward points on 15k monthly spends.

Annual fee: ₹499 + GST

It's not free or LTF as users these days would expect from new entry-level cards but the bunch of offers and rewards it offers could be worth the price tag it comes with. There is an additional annual ₹199+GST charge for activating UPI on the card which has never been seen in any other cards. Also, UPI transactions won't count towards the milestones and the value of reward points is also uncertain but should get clear as more people start receiving it.

Also, there is no credit revolve feature which means you can't take the remaining balances on your card towards next month, you either pay in full or convert them into EMI which might people doubt if this even is a real card or another BNPL scheme in the making.

How will stand the stiff competition from the other banks and rising Rupay cards, we will have to wait and see.

What do you guys think about it?

One More Useless card from idfc card As Simple As that(based on my preference)

Indeed, I think they should just take designing contracts for other credit card companies and stop offering new cards themselves.

AritraSaha

TF Prestige

IFDC has launched a new credit card - First Swyp

On the first look, the design looks very funky and modern and that's a good start in a market filled with dull cards.

View attachment 37074

What do you get with the card?

- ₹49 monthly conversion fee for turning your >₹2500 transactions into EMIs(no interest or other fees).

- TimesPrime annual membership on spending ₹30,000

- 4 Complimentary Railway Lounge Access

- 1% fuel surcharge waiver up to ₹200 p.m.

And it comes with a bunch of offers like:

- Dominos: 20% off up to ₹80 on orders above ₹299 twice in a month

- Easemytrip: 10% instant discount up to ₹500 on flight or hotel bookings above ₹5,000 once a quarter

- TataCLIQ: 10% instant discount up to ₹100 on purchases above ₹999 once on a month

- Zomato: Get 10% off up to ₹100 on orders above ₹299 twice in a month

You also get points for hitting monthly milestones,

200 reward points on 5k monthly spends.

500 reward points on 10k monthly spends.

1000 reward points on 15k monthly spends.

Annual fee: ₹499 + GST

It's not free or LTF as users these days would expect from new entry-level cards but the bunch of offers and rewards it offers could be worth the price tag it comes with. There is an additional annual ₹199+GST charge for activating UPI on the card which has never been seen in any other cards. Also, UPI transactions won't count towards the milestones and the value of reward points is also uncertain but should get clear as more people start receiving it.

Also, there is no credit revolve feature which means you can't take the remaining balances on your card towards next month, you either pay in full or convert them into EMI which might people doubt if this even is a real card or another BNPL scheme in the making.

How will stand the stiff competition from the other banks and rising Rupay cards, we will have to wait and see.

What do you guys think about it?

This seems useless. I mean people can get better IDFC Core CC, or if not that, then even Wow seems a better alternative IMOIFDC has launched a new credit card - First Swyp

On the first look, the design looks very funky and modern and that's a good start in a market filled with dull cards.

View attachment 37074

What do you get with the card?

- ₹49 monthly conversion fee for turning your >₹2500 transactions into EMIs(no interest or other fees).

- TimesPrime annual membership on spending ₹30,000

- 4 Complimentary Railway Lounge Access

- 1% fuel surcharge waiver up to ₹200 p.m.

And it comes with a bunch of offers like:

- Dominos: 20% off up to ₹80 on orders above ₹299 twice in a month

- Easemytrip: 10% instant discount up to ₹500 on flight or hotel bookings above ₹5,000 once a quarter

- TataCLIQ: 10% instant discount up to ₹100 on purchases above ₹999 once on a month

- Zomato: Get 10% off up to ₹100 on orders above ₹299 twice in a month

You also get points for hitting monthly milestones,

200 reward points on 5k monthly spends.

500 reward points on 10k monthly spends.

1000 reward points on 15k monthly spends.

Annual fee: ₹499 + GST

It's not free or LTF as users these days would expect from new entry-level cards but the bunch of offers and rewards it offers could be worth the price tag it comes with. There is an additional annual ₹199+GST charge for activating UPI on the card which has never been seen in any other cards. Also, UPI transactions won't count towards the milestones and the value of reward points is also uncertain but should get clear as more people start receiving it.

Also, there is no credit revolve feature which means you can't take the remaining balances on your card towards next month, you either pay in full or convert them into EMI which might people doubt if this even is a real card or another BNPL scheme in the making.

How will stand the stiff competition from the other banks and rising Rupay cards, we will have to wait and see.

What do you guys think about it?

They wanted to create product inclined towards millenials similar to SC Digismart but another failed attempt. Sirf quirky design kaafi nhi hota.IFDC has launched a new credit card - First Swyp

On the first look, the design looks very funky and modern and that's a good start in a market filled with dull cards.

View attachment 37074

What do you get with the card?

- ₹49 monthly conversion fee for turning your >₹2500 transactions into EMIs(no interest or other fees).

- TimesPrime annual membership on spending ₹30,000

- 4 Complimentary Railway Lounge Access

- 1% fuel surcharge waiver up to ₹200 p.m.

And it comes with a bunch of offers like:

- Dominos: 20% off up to ₹80 on orders above ₹299 twice in a month

- Easemytrip: 10% instant discount up to ₹500 on flight or hotel bookings above ₹5,000 once a quarter

- TataCLIQ: 10% instant discount up to ₹100 on purchases above ₹999 once on a month

- Zomato: Get 10% off up to ₹100 on orders above ₹299 twice in a month

You also get points for hitting monthly milestones,

200 reward points on 5k monthly spends.

500 reward points on 10k monthly spends.

1000 reward points on 15k monthly spends.

Annual fee: ₹499 + GST

It's not free or LTF as users these days would expect from new entry-level cards but the bunch of offers and rewards it offers could be worth the price tag it comes with. There is an additional annual ₹199+GST charge for activating UPI on the card which has never been seen in any other cards. Also, UPI transactions won't count towards the milestones and the value of reward points is also uncertain but should get clear as more people start receiving it.

Also, there is no credit revolve feature which means you can't take the remaining balances on your card towards next month, you either pay in full or convert them into EMI which might people doubt if this even is a real card or another BNPL scheme in the making.

How will stand the stiff competition from the other banks and rising Rupay cards, we will have to wait and see.

What do you guys think about it?

I don't like the trend of changing some alphabet of actual words. They can use actual words there is no copyright on those.Swyp

Similar threads

- Question

- Replies

- 23

- Views

- 1K

- Question

- Replies

- 6

- Views

- 161

- Replies

- 54

- Views

- 2K

- Question

- Replies

- 182

- Views

- 6K

- Question

- Replies

- 268

- Views

- 9K