any updates for the second card or any more payments?I did multiple trxns yesterday using sbi unipay 1 Lakh+ and all went through in secs.

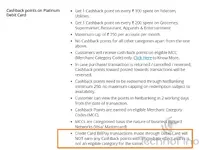

now regarding DC RP -

HDFC platinum DC - for one dc RP credited within 12 hrs but for another account platinum DC still RP not credited.

Indus Excl MC & Sign and Platinum - waiting for RP to get credited yet.

IDFC DC - waiting for RP to get credited yet.

I made a txn on SBI unipay 2-3 days ago.. no points yet..