Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

PSA : Stop using BharatNXT immediately

- Thread starter ChurningNoob

- Start date

- Replies 168

- Views 20K

Question is not if Bank can fund RP or not from its revenue.Well if banks were losing money on this transactions they will definately take action. but since the rp is being given out of the mdr which is being paid by the merchant or customer i dont see any problem

Bank just want to stop the usage for such fake txns where purchase of actual goods/Services is not involved.

If Bank will give benifts from its Pocket to such Customers then Devaluation is the last option

Suppose we are Paying Taxes i.e, GST/Income Tax/ Property Tax etc...to Government

In return we expect from Government such Taxes will be reinvested for the welfare of the society but due to some corrupt People our Hard earned money go in the hands of Such Corrupt people and what society gets this 🥚

Similiarly Bank will focus on Giving Rewards to Real Spenders for long time from its revenue

Or

Rotatters pe apna revenue loota ke jaldi se Devaluation le aaye ?

Last edited:

Understood thanks. Pretty straightforward I guess and easy for banks. I have used this BT only for 2-3 txns in the last couple of months for transferring to family acct and haven't registered even one Axis Bank on that portal. I too understood this is extremely fraught with risks with many Magnus holders using this way to achieve the monthly milestones. Having said this, my worry is Axis penalizing the people who use the method than actually cutting the merchant itself. I think if their internal systems have classified this as a B2B portal why not only allow Corporate cards or those BINs txns to go through. Its very easy for them to decline all retail spends on the portal using Axis Cards. This approach of hitting the user is flummoxing to say the least.MID refers to Merchant Identification number, which is basically a unique code assigned to every merchant.

It helps a bank in various ways and one of them is to filter out all trxns pertaining to a single merchant like BharatNXT in this case.

Some people are under the impression that bank cannot track it because it falls under utility category.

So, instead of devaluing/removing Utility MCC from Axis HNI cards, they directly filtered MID.

CARDBITRAGE

TF Legend

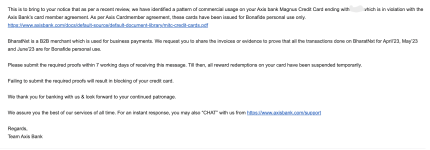

This was bound to happen. The question was when. A lot of people will be closing their cards. XDMany have received email from Axis asking justification for using Bharthnxt app.

Better to avoid BharatNXT and use Snapay app.

Snapay app charge 1.18% only and direct transfer to your bank account.

Snapay app charge 1.18% only and direct transfer to your bank account.

Benifits bhi Explain kar dete Snapay ke lage haath 😂Better to avoid BharatNXT and use Snapay app.

Snapay app charge 1.18% only and direct transfer to your bank account.

So you edited the comment before my comment 😂

Further Benifts bhi bta dete🤣

Bharatnxt also does that 🤣Better to avoid BharatNXT and use Snapay app.

Snapay app charge 1.18% only and direct transfer to your bank account.

You are not understanding bank apne jeb se nahi nikal rahi yeh paisaQuestion is not if Bank can fund RP or not from its revenue.

Bank just want to stop the usage for such fake txns where purchase of actual goods/Services is not involved.

If Bank will give benifts from its Pocket to such Customers then Devaluation is the last option

Suppose we are Paying Taxes i.e, GST/Income Tax/ Property Tax etc...to Government

In return we expect from Government such Taxes will be reinvested for the welfare of the society but due to some corrupt People our Hard earned money go in the hands of Such Corrupt people and what society gets this 🥚

Similiarly Bank will focus on Giving Rewards to Real Spenders for long time from its revenue

Or

Rotatters pe apna revenue loota ke jaldi se Devaluation le aaye ?

aadmi khud upfront paisa de hi raha hai 1-1.5% charges mein aur baaki 1% bharat nxt deta hoga.

In the end banks ko har transaction pe mdr milta hai but since they are are a corporate they get to bully people.

Until and unless there are loopholes they would be used for benefit no doubt but if i pay charges and stil i am not receiving the benefit it doesnt make sense

Snapay transaction count under Utility billpay. So, you can complete your Axis Magnus milestone benefit.Benifits bhi Explain kar dete Snapay ke lage haath 😂

So you edited the comment before my comment 😂

Further Benifts bhi bta dete🤣

Main Benifit PWR ka🤣Snapay transaction count under Utility billpay. So, you can complete your Axis Magnus milestone benefit.

Better to avoid these kind of apps bhai in my view. Mainstream apps better hai. Bank in sb txn ko suspicious hi count krti.Benifits bhi Explain kar dete Snapay ke lage haath 😂

So you edited the comment before my comment 😂

Further Benifts bhi bta dete🤣

Faltu me milestone complete krne k liye ache cards ki lanka lg jaegi kya matlab. Jab spends ni h to lena hi ni chaiye ye sb cards.

Yeh copy paste rakhlo -Main Benifit PWR ka🤣

There are plenty of threads with credit card to bank transfer. And the best one is Snapay (just check it's reviews on play store and iOS) and compare with other apps. It is best option with very low failure rates (u get option to provide some other account details in case of failure).

People keep asking me in chat. So here I am writing one detailed post on this. I have been using it since over an year and many people are using for more than that without any issues.

Prerequisites -

1. Complete Full KYC with Aadhar and PAN.

2. Register with Twid pay with reward programmes and understand their benefits. Top 3 reward programs are intermiles, zillion and supercoin.

3. Intermiles can be used to get discount on Amazon vouchers (25 discount on 500 using 61 intermiles, i mostly go with this), Purchase Amazon vouchers directly (500 voucher for 2900 intermiles) and Flight tickets (u need to keep checking regularly to get good value). It can also be used on Twid pay to pay partially at 0.25 per points (u won't get points when redeeming). There are additional vouchers when u cross intermiles tiers, which give a good boost as well In general, I rate it at 0.22rs per intermiles as a conservative estimate.

4. Payback/Zillion is similar to intermiles. U can buy Amazon vouchers at 0.25 per point from payback Gyftr (most used by me). Or It can also be used on Twid pay to pay partially at 0.25 per points (u won't get points when redeeming). In general, I rate it at 0.22rs per payback point as a conservative estimate.

5. Supercoins - Best value u get is on cleartrip (1 point is 1 rupee). It has very low capping, so it is good for small transaction of 1500-2000. Though I avoid accumulating too much now a days, as cleartrip is changing SuperCoin usage continuosly.

6. Add your bank account or credit card , in which u want payment as beneficiary under utility payments category. For credit card, account number is same as credit card number and IFSC code can be obtained from google (say search sbi credit card neft payment for sbi IFSC code). Mobile number can be anything other than urs, it doesn't send anything on that number.

Now that you understand these prerequisites, here is the payment method.

1. Go to utility payments, select beneficiary, select any purpose (general payments or credit card payment or anything else), select sender for better returns, T+1 as transaction method and Pay with rewards as payment method.

2. Ensure that u see 2.5% charges. Usually they take 3.5% charges, but often run offers with 2.5% charges. Do transaction only during offer period.

3. Login to PWR account and select Intermiles/Zillion as payment method depending on which is giving better returns. It keeps changing from 3-10% depending on offers. Divide that by 4 to calculate the value u will get.

4. Check the cashback amount also. This varies from 0.5-1.5% depending on offers.

5. In general sum of intermiles/zillion divide by 4 and cashback amount easily exceed 2%. So, effective charge will be less than 0.5%. Don't transact if it doesn't exceed that and wait for better offers.

6. Sometimes it gives pretty good offers like 0.2% net charge or even 0%, though that is a bit rare. 0.5% net charge is pretty easy to get.

7. Now use any visa/mastercard/rupay card for payment. Diners and Amex doesn't work. Some of rupay cards also don't work. You will get reward points based on utility category (4900 MCC). Any card with more than 0.5% reward rate on utility category will make it net positive return.

8. Now to use the cashback, u got in previous transaction, u need to do another transaction of minimum 1500. Repeat same process as above. SuperCoins earn option is better for this small value transaction. Don't use supercoins redeem option, that gives terrible return.

9. You may also use cashback on magicpin twidpay to buy small value vouchers without any minimum transaction criterion.

Bonus benefits -

1. You can pay credit card bill using UPI under credit card payment tab and get 1% cb (minimum amount should be 2000) in snapay wallets.

2. This can be used for 50% of convinience fee when using utility payments for same day category.

3. Same day charges are 3% and T+1 charge is 2.5%. So, in net , u r saving 1% (u need to pay 1.5% instead of 2.5%) using 1.5% from snapay wallet. So basically u r getting 0.67% return on credit card payments via UPI . Of course, this is only when u intend to use utility payments.

Transaction limits -

1. 20K per transaction, 5 transaction per day for T+1

2. 15K per transaction, 1 transaction per day for same day

In general, Snapay won't ban you for any transfer under above limits. It is literally written in their description as official method for credit card to bank transfer. They just want to be sure that transactions are genuine and there won't be any chargeback. So don't use any card which is not in ur name to avoid any payment stuck issues.

But credit card company may see it as misuse. Utility category mcc has very low mdr. In general, I feel if ur usage don't exceed 30% of credit limit, it's all fine.

I have tried to cover everything in this detailed post. Please don't PM me. Everything I know is listed already and u need to re-read, if u r not seeing something. The whole purpose of this post is to avoid those DMs

Last edited:

credit

TF Buzz

Do you know any websites, where one can buy crypto using credit card?Crypto purchase is legal

Secondly you can gamble online using your credit card try it out.

Thank you

IYeh post paste rakhlo -

There are plenty of threads with credit card to bank transfer. And the best one is Snapay (just check it's reviews on play store and iOS) and compare with other apps. It is best option with very low failure rates (u get option to provide some other account details in case of failure).

People keep asking me in chat. So here I am writing one detailed post on this. I have been using it since over an year and many people are using for more than that without any issues.

Prerequisites -

1. Complete Full KYC with Aadhar and PAN.

2. Register with Twid pay with reward programmes and understand their benefits. Top 3 reward programs are intermiles, zillion and supercoin.

3. Intermiles can be used to get discount on Amazon vouchers (25 discount on 500 using 61 intermiles, i mostly go with this), Purchase Amazon vouchers directly (500 voucher for 2900 intermiles) and Flight tickets (u need to keep checking regularly to get good value). It can also be used on Twid pay to pay partially at 0.25 per points (u won't get points when redeeming). There are additional vouchers when u cross intermiles tiers, which give a good boost as well In general, I rate it at 0.22rs per intermiles as a conservative estimate.

4. Payback/Zillion is similar to intermiles. U can buy Amazon vouchers at 0.25 per point from payback Gyftr (most used by me). Or It can also be used on Twid pay to pay partially at 0.25 per points (u won't get points when redeeming). In general, I rate it at 0.22rs per payback point as a conservative estimate.

5. Supercoins - Best value u get is on cleartrip (1 point is 1 rupee). It has very low capping, so it is good for small transaction of 1500-2000. Though I avoid accumulating too much now a days, as cleartrip is changing SuperCoin usage

Kundali Khol ke rakh di Snapay ki.🤣Yeh post paste rakhlo -

There are plenty of threads with credit card to bank transfer. And the best one is Snapay (just check it's reviews on play store and iOS) and compare with other apps. It is best option with very low failure rates (u get option to provide some other account details in case of failure).

People keep asking me in chat. So here I am writing one detailed post on this. I have been using it since over an year and many people are using for more than that without any issues.

Prerequisites -

1. Complete Full KYC with Aadhar and PAN.

2. Register with Twid pay with reward programmes and understand their benefits. Top 3 reward programs are intermiles, zillion and supercoin.

3. Intermiles can be used to get discount on Amazon vouchers (25 discount on 500 using 61 intermiles, i mostly go with this), Purchase Amazon vouchers directly (500 voucher for 2900 intermiles) and Flight tickets (u need to keep checking regularly to get good value). It can also be used on Twid pay to pay partially at 0.25 per points (u won't get points when redeeming). There are additional vouchers when u cross intermiles tiers, which give a good boost as well In general, I rate it at 0.22rs per intermiles as a conservative estimate.

4. Payback/Zillion is similar to intermiles. U can buy Amazon vouchers at 0.25 per point from payback Gyftr (most used by me). Or It can also be used on Twid pay to pay partially at 0.25 per points (u won't get points when redeeming). In general, I rate it at 0.22rs per payback point as a conservative estimate.

5. Supercoins - Best value u get is on cleartrip (1 point is 1 rupee). It has very low capping, so it is good for small transaction of 1500-2000. Though I avoid accumulating too much now a days, as cleartrip is changing SuperCoin usage continuosly.

6. Add your bank account or credit card , in which u want payment as beneficiary under utility payments category. For credit card, account number is same as credit card number and IFSC code can be obtained from google (say search sbi credit card neft payment for sbi IFSC code). Mobile number can be anything other than urs, it doesn't send anything on that number.

Now that you understand these prerequisites, here is the payment method.

1. Go to utility payments, select beneficiary, select any purpose (general payments or credit card payment or anything else), select sender for better returns, T+1 as transaction method and Pay with rewards as payment method.

2. Ensure that u see 2.5% charges. Usually they take 3.5% charges, but often run offers with 2.5% charges. Do transaction only during offer period.

3. Login to PWR account and select Intermiles/Zillion as payment method depending on which is giving better returns. It keeps changing from 3-10% depending on offers. Divide that by 4 to calculate the value u will get.

4. Check the cashback amount also. This varies from 0.5-1.5% depending on offers.

5. In general sum of intermiles/zillion divide by 4 and cashback amount easily exceed 2%. So, effective charge will be less than 0.5%. Don't transact if it doesn't exceed that and wait for better offers.

6. Sometimes it gives pretty good offers like 0.2% net charge or even 0%, though that is a bit rare. 0.5% net charge is pretty easy to get.

7. Now use any visa/mastercard/rupay card for payment. Diners and Amex doesn't work. Some of rupay cards also don't work. You will get reward points based on utility category (4900 MCC). Any card with more than 0.5% reward rate on utility category will make it net positive return.

8. Now to use the cashback, u got in previous transaction, u need to do another transaction of minimum 1500. Repeat same process as above. SuperCoins earn option is better for this small value transaction. Don't use supercoins redeem option, that gives terrible return.

9. You may also use cashback on magicpin twidpay to buy small value vouchers without any minimum transaction criterion.

Bonus benefits -

1. You can pay credit card bill using UPI under credit card payment tab and get 1% cb (minimum amount should be 2000) in snapay wallets.

2. This can be used for 50% of convinience fee when using utility payments for same day category.

3. Same day charges are 3% and T+1 charge is 2.5%. So, in net , u r saving 1% (u need to pay 1.5% instead of 2.5%) using 1.5% from snapay wallet. So basically u r getting 0.67% return on credit card payments via UPI . Of course, this is only when u intend to use utility payments.

Transaction limits -

1. 20K per transaction, 5 transaction per day for T+1

2. 15K per transaction, 1 transaction per day for same day

In general, Snapay won't ban you for any transfer under above limits. It is literally written in their description as official method for credit card to bank transfer. They just want to be sure that transactions are genuine and there won't be any chargeback. So don't use any card which is not in ur name to avoid any payment stuck issues.

But credit card company may see it as misuse. Utility category mcc has very low mdr. In general, I feel if ur usage don't exceed 30% of credit limit, it's all fine.

I have tried to cover everything in this detailed post. Please don't PM me. Everything I know is listed already and u need to re-read, if u r not seeing something. The whole purpose of this post is to avoid those DMs

Itna detailed comment expect nhi kiya thha.

I must appreciate your efforts if you type the whole comment yourself and now copy pasted it

Last edited:

I didn't write it.I

Kundali Khol ke rakh di Snapay ki.🤣

I must appreciate your efforts if you type the whole comment yourself and now copy pasted it

I had read one that allowed don't remember it's nameDo you know any websites, where one can buy crypto using credit card?

Thank you

Kindly check on google

Even BharathNxt count as Utility ,The point is overspending on same merchant for more than 3 months for huge amount for milestone and reward points made Axis bank for explanationSnapay transaction count under Utility billpay. So, you can complete your Axis Magnus milestone benefit.

Jisne bhi kiya hai kaafi achha explain kiya.I didn't write it.

Agar Exam m question aata snapay ke upar toh Teacher bhi shocked ho jata aisa answer dekh ke🤣

This. 😁Tell them that all were for personal money rotation and not for business use.

BharathNxt is B2B merchant, Axis mail clearly mentioned but Snapay is not B2B merchant.Even BharathNxt count as Utility ,The point is overspending on same merchant for more than 3 months for huge amount for milestone and reward points made Axis bank for explanation

ashishsinghi

TF Select

And here i was thinking of getting magnus😒Life mei har jagah late hi paucha😂

Similar threads

- Question

- Replies

- 2

- Views

- 285

- Question

- Replies

- 3

- Views

- 477

- Replies

- 13

- Views

- 1K