HDFC Tata Neu quietly adjusts the criteria for earning Neu Coins. I noticed the change when Neu Coins began appearing within the billing cycle for UPI transactions instead of calendar month

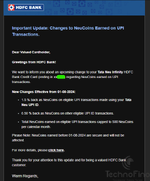

As per latest

Previously, cumulative spending on transactions totaling certain amounts (like 10, 20, 30) would earn you 1.5% on the total amount. However, due to these recent changes, you now need to spend at least Rs 34 to earn at least 1 Neu Coin due to neu coin earning based on each transaction settlement.

For instance, if you've made four transactions in the past four days and had 100 Neu Coins in accrual six days earlier:

1 more silent devaluation

wef 1 Aug, 2024

0.5% will be provided for all upi apps and need to pay min. 100(or 99) to earn anything)

Additional 1% will be provided with Tata Neu APP upi (min. spend will be Rs.50 to earn anything)

As per latest

Tata Neu Infinity Card Minor Devaluation on UPI spends but ease spend calculations

W.E.F 02-May-2024 for Grocery / UPI / Insurance Related transactions settled from 1-May-24 -

For eligible Grocery / UPI / Insurance transactions, NeuCoins will be posted within 2 days of settlement of the transaction, for example the points for transaction settled on 1st Jul will be posted by 3 rd Jul and will be available for redemption by 8 th Aug)

Previously, cumulative spending on transactions totaling certain amounts (like 10, 20, 30) would earn you 1.5% on the total amount. However, due to these recent changes, you now need to spend at least Rs 34 to earn at least 1 Neu Coin due to neu coin earning based on each transaction settlement.

For instance, if you've made four transactions in the past four days and had 100 Neu Coins in accrual six days earlier:

- Rs.1800 UPI transactions earn 27 Neu Coins, bringing the accrual to 127.

- Rs.30 transaction doesn't affect the accrual, as cumulative spending no longer applies (here mark a silent minor devaluation but impacts much to me, due to many transactions are 20,30)

- Rs.120 transaction adds 2 more Neu Coins, making the accrual 129.

- Rs.50 transaction adds 1 Neu Coin, resulting in an accrual of 130.

- .... and so on.

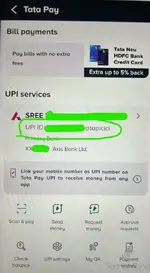

1 more silent devaluation

wef 1 Aug, 2024

0.5% will be provided for all upi apps and need to pay min. 100(or 99) to earn anything)

Additional 1% will be provided with Tata Neu APP upi (min. spend will be Rs.50 to earn anything)

Last edited: