Abdullāh Khān

TF Select

Hello everyone

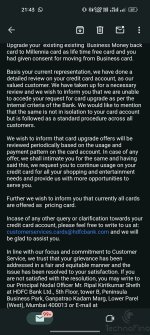

My credit history began in July/23 and I was offered Business M.B CC as my first card (the others being CSC, and other cr*p) and I excitedly accepted it as it was my first CC offering. I have a current and savings account with them, current is already in the classic program.

Got a limit of 1L, and have been using the card regularly, their annual waiver req (50k) I spent

/spend in one quarter, but still, I haven't gotten a single limit enhancement offers, or worse I wasn't aware how "good" this card is, then.

Is there any way that I can convince them to issue me a Milennia instead of this cr*p, or am I stuck with this? It's a tier 3 city and here nobody cares enough about all of this.

I have no other CCs from any other bank. Suggest me the best course of action, as I'm still new into the CC game. 🙂

Thanks in advance to everyone.

My credit history began in July/23 and I was offered Business M.B CC as my first card (the others being CSC, and other cr*p) and I excitedly accepted it as it was my first CC offering. I have a current and savings account with them, current is already in the classic program.

Got a limit of 1L, and have been using the card regularly, their annual waiver req (50k) I spent

/spend in one quarter, but still, I haven't gotten a single limit enhancement offers, or worse I wasn't aware how "good" this card is, then.

Is there any way that I can convince them to issue me a Milennia instead of this cr*p, or am I stuck with this? It's a tier 3 city and here nobody cares enough about all of this.

I have no other CCs from any other bank. Suggest me the best course of action, as I'm still new into the CC game. 🙂

Thanks in advance to everyone.