Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hdfc cc new limit

- Thread starter Cc_creditguy

- Start date

- Replies 169

- Views 8K

Make sure to apply via co branded apps only for flawless approval.unlimited co branded ... cool thats fine

Apply & convince HDFC over email to approve it.How to get HDFC core card if i already have co-branded card🥲

And it's possible to get core after cobranded but not that easy.

You can do it.

Read this .. some popcorn time...How to get HDFC core card if i already have co-branded card🥲

Anyone got HDFC Core Card as a Second Card after having HDFC Tata Neu card as their first ever (Debut) Card

Want to know if anyone got (either thru pre approved / online/ offline) a HDFC core card like regalia, Millinea etc as their 2nd card after having the Tata Neu Card as their first ever card? If anyone got a card like this, then it would be contrary to the following HDFC's advice in response to...

www.technofino.in

www.technofino.in

MudraMantra

TF Select

I totally agree with you @SSV , if we have multiple cards like 10/15 or 20+ and for each card we have higher credit limit for example 10 lakh each then for 20 cards it will be like 2 CR CL, so in order to justify this one should have CTC similar to that otherwise Credit bureaus will mark them as over leverage on credit.I am not saying we dont need HIGH CLs .. HIGH CL in one or two main cards is enough..

For me I have more than 15 Cards..

If we have high CLs on all the cards, we will end up as "Highly leveraged " and wont get any Credit cards in future..

So what you suggested is good, we can have high CL on 1 or 2 premium cards and for others we can have moderate CL so that we are not marked as HIGH Leveraged.

I have 4 years of work experience in one of the credit bureaus.

Thanks for your appreciation..bhai literally iam saying you have knowledge on every card ..... hats off to be honest

But let me tell you, there are many many who knows more than me and more experinced than me...

I only have about 2 years of real serious experience in the Indian CC market ...

Still I take it as a compliment.. Cheers

... for 20 cards it will be like 2 CR CL, so in order to justify this one should have CTC similar to that otherwise Credit bureaus will mark them as over leverage on credit.

the credit bureaus.

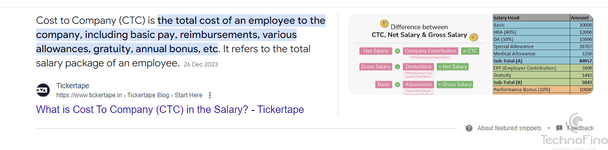

What is "CTC"?

.

SAS

TF Premier

bhai my brother just got his first hdfc credit card with limit 1.35L ... now my doubt is how long should we wait to apply for tata neu and swiggy hdfc .... i mean can we immediately apply for co branded cards or do we need to wait for a month or so ???Thanks for your appreciation..

But let me tell you, there are many many who knows more than me and more experinced than me...

I only have about 2 years of real serious experience in the Indian CC market ...

Still I take it as a compliment.. Cheers

immediatley .. .bhai my brother just got his first hdfc credit card with limit 1.35L ... now my doubt is how long should we wait to apply for tata neu and swiggy hdfc .... i mean can we immediately apply for co branded cards or do we need to wait for a month or so ???

Yes .. generallybhai .... okka HDFC main credit card unte .... automatic ga tata neu and swiggy easy ga approve aipothay kada with the same limit of previous card ????

bhai my brother just got his first hdfc credit card with limit 1.35L ... now my doubt is how long should we wait to apply for tata neu and swiggy hdfc .... i mean can we immediately apply for co branded cards or do we need to wait for a month or so ???

why people are hesitant to reveal the complete details...

Which core card your brother got.. you only said with 1.35L card?? and want to get Tata Neu card and Swiggy card//

This actually helps the guys who want to give some advise who have got some experience..

I see a lot of people, just reveal only half the details and later into discussion they come up with more details.

This generally wastes everyone's time....

This is aimed generally at everyone..

Last edited:

SAS

TF Premier

okok i have nothing to hide i just thought seniors will feel its lenghty to read .... actually my brother is a priest so i have applied it when i got pre edligible offer so i filled all the details and the available cards are only showing some business cards like BIZ series basic 3 variants so i opted for BIZ grow card ..... and just received virtual credit card and also got physical card dispatched mail ...... he have special gold savings account 1 lakh AMB .... and we are into family claissc grouping and he is also having platinum debit card ........ after a long wait of 7 months he got this card ... that to not pre approval its just pre elidgible ..... so dare chesi apply chesa lucky ga vachesindi ....... adhi peddga use leni card kada anduke swiggy and tata neu di apply cheddam anukunna ...... elago hdfc swiggy has high approval rates now andukey cheseddam ani mimmalni adiganu bro ... next time nunchi full details provide chesthaYes .. generally

why people ae hesitant to reveal the complete details...

Which core card your brother got.. you only said with 1.35L card?? and want to get Tata Neu card and Swiggy card//

THis actaully helps the guys who want to give some advise who have got soem experience..

I see a lot of people, just reveal only half the details and later into discussion they come up with more details..

THis is aimed generally at everyone..

actually your point is damn valid ......... (everyone please not it down)

SAS

TF Premier

Yes .. generally

why people are hesitant to reveal the complete details...

Which core card your brother got.. you only said with 1.35L card?? and want to get Tata Neu card and Swiggy card//

This actually helps the guys who want to give some advise who have got some experience..

I see a lot of people, just reveal only half the details and later into discussion they come up with more details.

This generally wastes everyone's time....

This is aimed generally at everyone..

Apply for Biz Grow Credit Card | HDFC Bank

Get 10X Cashpoints on your select business spends, such as bill payments, income tax payments, GST/vendor payments, etc, with HDFC Bank Biz Grow Credit Card. T&C Apply!

Okay go ahead and apply for Swiggy card..okok i have nothing to hide i just thought seniors will feel its lenghty to read .... actually my brother is a priest so i have applied it when i got pre edligible offer so i filled all the details and the available cards are only showing some business cards like BIZ series basic 3 variants so i opted for BIZ grow card ..... and just received virtual credit card and also got physical card dispatched mail ...... he have special gold savings account 1 lakh AMB .... and we are into family claissc grouping and he is also having platinum debit card ........ after a long wait of 7 months he got this card ... that to not pre approval its just pre elidgible ..... so dare chesi apply chesa lucky ga vachesindi ....... adhi peddga use leni card kada anduke swiggy and tata neu di apply cheddam anukunna ...... elago hdfc swiggy has high approval rates now andukey cheseddam ani mimmalni adiganu bro ... next time nunchi full details provide chestha

actually your point is damn valid ......... (everyone please not it down)

Make sure

1) you apply any co branded card from the brands app

2) make sure HDFC registered Mobile number and brand’s registered mobile number are same..

3) give at least a week gap between core card application and cobranded card, so that systems update all the data

4) After getting any card , make sure it is enabled and do one or two small transactions so that it gets registered in all the sub systems

Enjoy

Yes, high chances of approval of cobranded cards from their respective apps.Okay go ahead and apply for Swiggy card..

Make sure

1) you apply any co branded card from the brands app

2) make sure HDFC registered Mobile number and brand’s registered mobile number are same..

3) give at least a week gap between core card application and cobranded card, so that systems update all the data

4) After getting any card , make sure it is enabled and do one or two small transactions so that it gets registered in all the sub systems

Enjoy

SAS

TF Premier

and bhai after swiggy ..... should i again give gap for tata neu .... (actually i felt bad for 1.35 because if just 15k more limit vachi unte we can directly apply for tata infinity kada)Okay go ahead and apply for Swiggy card..

Make sure

1) you apply any co branded card from the brands app

2) make sure HDFC registered Mobile number and brand’s registered mobile number are same..

3) give at least a week gap between core card application and cobranded card, so that systems update all the data

4) After getting any card , make sure it is enabled and do one or two small transactions so that it gets registered in all the sub systems

Enjoy

Yes..and bhai after swiggy ..... should i again give gap for tata neu .... (actually i felt bad for 1.35 because if just 15k more limit vachi unte we can directly apply for tata infinity kada)

yes .

Similar threads

- Question

- Replies

- 5

- Views

- 206

- Replies

- 27

- Views

- 699

- Question

- Replies

- 2

- Views

- 322

- Question

- Replies

- 8

- Views

- 827

- Replies

- 8

- Views

- 188