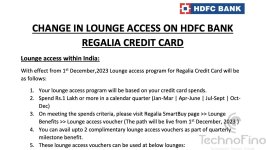

Important update on Lounge Access via HDFC Credit Cards from December 1st, 2023.

HDFC Regalia First

HDFC Regalia First

- Effective December 1st, 2023, Complimentary lounge access at lounges within and outside India can no longer be availed on Regalia First Card.

- To Access Domestic Lounges you need to spend Rs 1 lac in a quarter.

- The number of domestic lounge visits on HDFC Millennia reduced to 1 from 2 per quarter

- To Access Domestic Lounges you need to spend Rs 1 lac in a quarter.

- No condition is applicable for International Lounge access using PP issued with HDFC Regalia

- No changes were made.

Looks like another attempt by HDFC Bank to pocket annual fees by making people upgrade to Regalia Gold who are holding LTF HDFC Regalia and HDFC Millennia.

Attachments

Last edited: