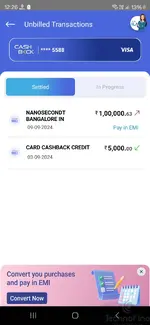

Update [13-09-2024] : As you all are aware (most probably) Limit increase request can be initiated once in 24hrs, so after getting first LE, tried second time but this time a red text error came after spinner and received ETA sms for request completion, zero hopes but still waiting for outcome (decline). Pic:

Original post👇🏼:

Original post👇🏼:

It was super quick !

Card is not a year old yet, spends was decent, having upgrade options in app (not interested).

Never expected this from SBICARDS.

I was just going through this thread and thought to go till last comment and then go to sleep but reaching till last comment

"THE CHULL" became so strong that i couldn't hold it and went straight to SBICARDS app, as usual nothing there. No worries because CHULL was so severe then headed to website and logged in found the increase limit option there (actually i get this option from day 1 of card issuance, never used bcz of cibil hit)

clicked it

Saw my card with current limit but no pre-approved (max) limit shown, it was current limit on Left and on the right side of bar was blank (no values just ₹ sign), however on left you've option to edit/type limit, so did and clicked submit Then otp then (as someone posted here)

spinner/wait sign appeared (not disappeared till page reload) and within 5-10 seconds sms recvd stating LEGENDARY ETA till 26-sep-2024, lost hopes.

Went to home page but then thought to go back, why not try once again (idk cibil hit or not)

Interesting part starts here

Saw on 2nd step a blue button activated (ready to be clicked) as second step for additional information, clicked it was something frkn .in (not exactly remember, someone already posted about this too) went ahead then uhmm....... "

ANUMATI" Ji appeared, went with flow happily

Took 10 seconds (after consent otp)

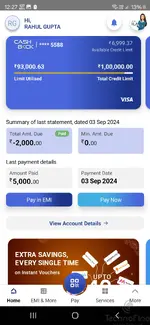

Just after ANUMATI sms (informing that SBICARDS accessed/requested my details) got another SMS back to back from SBICARDS that based on your SR (which have ETA till 26 sep) your limit increased from 1L to 2L (although i filled 5L similar to other cards) but that's not bad 100% increase that too instantly (Lucky enough?)

Current cibil 799 (decreased last month)

4 enquiries in Last 6m

Utilisation almost Zero.

Thanks 🙏🏼

Good night