I havenot spent much time on Marquee card lately..

So digging a little bit deep now..

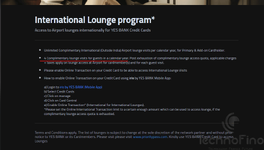

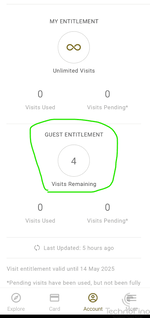

In the case of 8 free guest lounge access it is now confimred that the 8 were shared between Domestic and International equally by this SS available on the Marquee page...

So 8 Guest passes = 4 Domestic + 4 International... per calendar year ( not card anniversary) ..

I will update the same in the Post No 1...

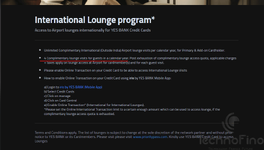

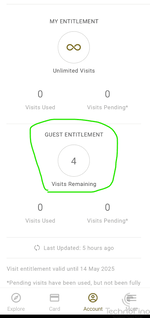

and also Priority Pass SS also confirms the same:

So digging a little bit deep now..

In the case of 8 free guest lounge access it is now confimred that the 8 were shared between Domestic and International equally by this SS available on the Marquee page...

So 8 Guest passes = 4 Domestic + 4 International... per calendar year ( not card anniversary) ..

I will update the same in the Post No 1...

and also Priority Pass SS also confirms the same:

Last edited: