Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

HDFC Limit Enhancement Offer

- Thread starter CardSeeker

- Start date

- Replies 144

- Views 20K

Deleted member 5552

TF Legend

I am not arguing here 😳😳😆His card is life time free. I don't know how much credit limit he holds now. Everything is possible in this world. Sometimes it depends on someone's luck also...I don't have any doubt. I didn't want to argue either. I know that there are always exceptions and many people get the cards without even qualifying basic eligibility criteria. But think logically why someone would pay rs 2500 + gst for meagre 60k limit? I also know that many people get it LTF. What I meant to say is people generally get higher limit for this premium card.

95kWhat is new limit after re applying

I agree with you totally.I don't have any doubt. I didn't want to argue either. I know that there are always exceptions and many people get the cards without even qualifying basic eligibility criteria. But think logically why someone would pay rs 2500 + gst for meagre 60k limit? I also know that many people get it LTF. What I meant to say is people generally get higher limit for this premium card.

Deleted member 5552

TF Legend

Why someone can't pay Rs 2500 if card gives good benefits? 😁I don't have any doubt. I didn't want to argue either. I know that there are always exceptions and many people get the cards without even qualifying basic eligibility criteria. But think logically why someone would pay rs 2500 + gst for meagre 60k limit? I also know that many people get it LTF. What I meant to say is people generally get higher limit for this premium card.

Card benefits do not depend on credit limit

Deleted member 5552

TF Legend

Why someone can't pay Rs 2500 if card gives good benefits? 😁I agree with you totally.

Card benefits do not depend on credit limit

It totally depends on the card holder to pay 2500 Plus GST for a card.Why someone can't pay Rs 2500 if card gives good benefits? 😁

Card benefits do not depend on credit limit

A)I have seen people paying 500 fees for just card limit of 10k limit.

B) There are people who pay 0 fees for card with limit of 10L(LTF/spend based waiver)

Now this TF community. Is made to help to give proper guidance to the users so that they can get maximum benefit without a cost.

Now if you are able to get benifit of Rs.3000 or more on the card. It's GOOD.

And yes. Card Benifit doesn't depend on limit. I myself have Infinia<5L.

If bank tells me to pay fees against which they will increase my limit. Definitely I will not accept.

Since you have reached to TF community. Just because you must be curious about cards. And wanted to save more and get more benifit without paying extra

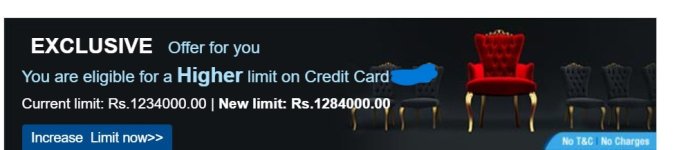

Did you checked here LE offer?Does checking LE will get cibil enquiry?

I tried to check in mycards.hdfcbank.com

View attachment 9884

What happens when you submit the details?

Deleted member 5552

TF Legend

1. With that 10k limit, a card holder can spend even more than lakhs. So I don't think 10k is bad limit if a card holder knows how to use card properly.It totally depends on the card holder to pay 2500 Plus GST for a card.

A)I have seen people paying 500 fees for just card limit of 10k limit.

B) There are people who pay 0 fees for card with limit of 10L(LTF/spend based waiver)

Now this TF community. Is made to help to give proper guidance to the users so that they can get maximum benefit without a cost.

Now if you are able to get benifit of Rs.3000 or more on the card. It's GOOD.

And yes. Card Benifit doesn't depend on limit. I myself have Infinia<5L.

If bank tells me to pay fees against which they will increase my limit. Definitely I will not accept.

Since you have reached to TF community. Just because you must be curious about cards. And wanted to save more and get more benifit without paying extra

2. I don't depend on huge credit limit, but my spends depend on my bank balance. So, if I have 5k limit, I can easily spend upto 70 k monthly and take the benefits of particular card. (This doesn't mean that I have low credit limit)

3. I am not curious about cards now, when I was really curious there were no websites available to learn. I learnt everything myself and now I help the other people to come to the new world banking/investment/cards/cashback with free of cost. I used all major banks cards and closed. Even I didn't find HDFC as good. Now I have Axis cards and I am aware of all benefits of my cards and how to get these benefits

Anon1

TF Premier

Didn't got offerDid you checked here LE offer?

What happens when you submit the details?

just 50k LE , this is first time in 8 year i have not received 2 lakhs LE, is this how it goes after reaching over 12 lakhs or it is just a phase and i shouldn't take this LE? if anyone here with more than 13-15 lakhs limit on their hdfc card let me know when was your last LE limit was for.

Attachments

Deleted member 8482

TF Select

Got Limit enhancement on my regalia from 3.25 to 6.80.Usage last 6 months around 6 lakhs😊

Deleted member 8482

TF Select

12 lakh Plus limit thats massive , which card u r using.I got LE on my regalia from 3.25 to 6.8😊just 50k LE , this is first time in 8 year i have not received 2 lakhs LE, is this how it goes after reaching over 12 lakhs or it is just a phase and i shouldn't take this LE? if anyone here with more than 13-15 lakhs limit on their hdfc card let me know when was your last LE limit was for.

infinia12 lakh Plus limit thats massive , which card u r using.I got LE on my regalia from 3.25 to 6.8😊

Deleted member 8482

TF Select

Great I like to have that much limit in future, may be after 2-3 years😊infinia

I have stuck on 4.92L. more than 4yinfinia

My usage on Regalia in the last 6 months is around 4 lakh, hoping to get LE from 3.45 lakhGot Limit enhancement on my regalia from 3.25 to 6.80.Usage last 6 months around 6 lakhs😊

Anon1

TF Premier

I logged in HDFC net banking which for only cc holders. Here I am getting options of upgrade and increase credit limit after selecting any one of the option, I am getting as below screenshot. So, Here If I proceed to confirm then will I get CIBIL enquiry? And will this send request for credit limit increase?

I am new to HDFC, kindly help in this.

I am new to HDFC, kindly help in this.

How Much MAB Are Maintaining In HDFC Bank A/C?Got Limit enhancement on my regalia from 3.25 to 6.80.Usage last 6 months around 6 lakhs😊

This is a common message when you check for LE and yea it is not gonna do a cibil hit.I logged in HDFC net banking which for only cc holders. Here I am getting options of upgrade and increase credit limit after selecting any one of the option, I am getting as below screenshot. So, Here If I proceed to confirm then will I get CIBIL enquiry? And will this send request for credit limit increase?

I am new to HDFC, kindly help in this. View attachment 10110

That is not the offer. I am getting this page since longI logged in HDFC net banking which for only cc holders. Here I am getting options of upgrade and increase credit limit after selecting any one of the option, I am getting as below screenshot. So, Here If I proceed to confirm then will I get CIBIL enquiry? And will this send request for credit limit increase?

I am new to HDFC, kindly help in this. View attachment 10110

Similar threads

- Replies

- 61

- Views

- 3K

- Replies

- 11

- Views

- 552

- Question

Regalia Gold

Should I request a limit enhancement or an upgrade?

- Replies

- 19

- Views

- 1K

- Question

- Replies

- 5

- Views

- 202

- Replies

- 286

- Views

- 17K