HDFC Bank Infinia is the best credit card available in India for frequent air travellers. HDFC Bank market this credit card as an invite only card, but in reality you can actually apply for this card.

Official Eligible Income Criteria For HDFC Infinia- 43L ITR (depends on location)

DCB - 24L ITR

If you don't have ITR of 43L/24L you can still get HDFC Infinia/DCB, you have to fulfil some other criteria.

This information is not available publicly on HDFC Bank website.

Hidden Criteria For "New HDFC Bank Infinia Credit Card" - You can apply for new HDFC Bank Infinia credit card using "Card To Card" method, you need a minimum 1 year old other bank credit card with minimum 10 lakhs credit limit for this.

"New HDFC Bank Diners Club Black Credit Card" - You can apply for new HDFC Bank DCB credit card using "Card To Card" method, you need a minimum 1 year old other bank credit card with minimum 5 lakhs credit limit for this.

If your already have a HDFC Bank credit card, then you have to upgrade your existing card to Infinia/DCB,

For Upgrade To Infinia-

1. You need minimum 8 lakhs credit limit on your existing HDFC Bank Credit card

2. Send an email to- grievance.redressalcc@hdfcbank.com & request for card upgrade, fill up and attach credit card upgrade form with the email.

*Credit card upgrade form (New Version) - attached with this thread.

For Upgrade To DCB-

1. You need minimum 5 lakhs credit limit on your existing HDFC Bank Credit card

2. Send an email to- grievance.redressalcc@hdfcbank.com & request for card upgrade, attach card upgrade form with the email.

Update- HDFC Bank asking for 10 lakhs limit on your existing credit card for infinia upgrade.

So, don't be surprised if hdfc bank ask you for 10L limit. 😃

Official Eligible Income Criteria For HDFC Infinia- 43L ITR (depends on location)

DCB - 24L ITR

If you don't have ITR of 43L/24L you can still get HDFC Infinia/DCB, you have to fulfil some other criteria.

This information is not available publicly on HDFC Bank website.

Hidden Criteria For "New HDFC Bank Infinia Credit Card" - You can apply for new HDFC Bank Infinia credit card using "Card To Card" method, you need a minimum 1 year old other bank credit card with minimum 10 lakhs credit limit for this.

"New HDFC Bank Diners Club Black Credit Card" - You can apply for new HDFC Bank DCB credit card using "Card To Card" method, you need a minimum 1 year old other bank credit card with minimum 5 lakhs credit limit for this.

If your already have a HDFC Bank credit card, then you have to upgrade your existing card to Infinia/DCB,

For Upgrade To Infinia-

1. You need minimum 8 lakhs credit limit on your existing HDFC Bank Credit card

2. Send an email to- grievance.redressalcc@hdfcbank.com & request for card upgrade, fill up and attach credit card upgrade form with the email.

*Credit card upgrade form (New Version) - attached with this thread.

For Upgrade To DCB-

1. You need minimum 5 lakhs credit limit on your existing HDFC Bank Credit card

2. Send an email to- grievance.redressalcc@hdfcbank.com & request for card upgrade, attach card upgrade form with the email.

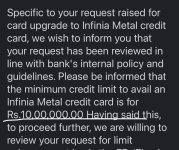

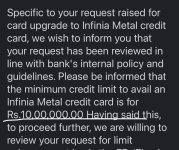

Update- HDFC Bank asking for 10 lakhs limit on your existing credit card for infinia upgrade.

So, don't be surprised if hdfc bank ask you for 10L limit. 😃

Attachments

Last edited: