can we use card at international lounges or do we get PP ? also how does guest access for intl lounge worksIf someone doesn't have a movie card (1 + 1) , you can go for this card. I have already used for 3 tickets worth of 1200 off in last 1.5 months. I feel this benefit is worth as much as lounge benefit. For me while considering this card while analysis, if you go to movie once in a month also in a year it gives back the joining fee . some users will cry for 0.5 % cashback for UPI till 500 rupee, but using this card you can extract a lot only using for movies. Think about it, for lounge a normal person will be using 4 times a year that too if you are travelling. But for movie you can even max out 3 times a month if you have friends and family who you can send them.

PS: think about your use case before taking a card, don't get attracted by FOMO.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Yes Bank MARQUEE Credit Card launched - Features & Benefits | Full Details

- Thread starter SSV

- Start date

- Replies 2K

- Views 136K

don't forget that joining fee / renewal fee comes back as points.. so effectively almost free for 3 yrsIf someone doesn't have a movie card (1 + 1) , you can go for this card. I have already used for 3 tickets worth of 1200 off in last 1.5 months. I feel this benefit is worth as much as lounge benefit. For me while considering this card while analysis, if you go to movie once in a month also in a year it gives back the joining fee . some users will cry for 0.5 % cashback for UPI till 500 rupee, but using this card you can extract a lot only using for movies. Think about it, for lounge a normal person will be using 4 times a year that too if you are travelling. But for movie you can even max out 3 times a month if you have friends and family who you can send them.

PS: think about your use case before taking a card, don't get attracted by FOMO.

nemesis23

TF Select

No PP. CARD swipe only. Tell them I have guest access with my card. And read the first post of SSV , where everything is written.can we use card at international lounges or do we get PP ? also how does guest access for intl lounge works

And also I had availed domestic lounge access along withb2 guests in Guwahati earlier this month with swipe of this card for ₹2..No PP. CARD swipe only. Tell them I have guest access with my card. And read the first post of SSV , where everything is written.

An excellent dard

Card itself acts as PP card..can we use card at international lounges or do we get PP ? also how does guest access for intl lounge works

Swipe of this card is enough.

Make sure international transactions are enabled

s

same for meReceived the card today.. i applied on 26 july but my welcome letter has mentioned 60000 reward points as joining bonus.

googley

TF Buzz

The Joining Benefit has now been reduced to 40K points only and not 60K points:

aw123456

TF Neo

They have now slashed joining reward points to 40000 now in stead of 60it seems everything is very late with YES.. haven't been charged the joining fee yet , even after 40 days after cc was opened...

unfortunately I can't help you about Rs500 GV , as I applied thru an agent

Yes, I noted it in my first postThey have now slashed joining reward points to 40000 now in stead of 60

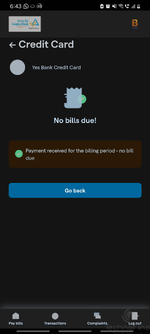

Seems Yes Bank is live on BBPS. It’s listed on Canara Bank Setu and I was able to fetch “No due” status using RMN and last 4 digit of the CC. Can anyone with pending payment try?

@SSV @plastikman @D₹V @diptarkaroy

@SSV @plastikman @D₹V @diptarkaroy

Bill generated ?Seems Yes Bank is live on BBPS. It’s listed on Canara Bank Setu and I was able to fetch “No due” status using RMN and last 4 digit of the CC. Can anyone with pending payment try?

@SSV @plastikman @D₹V @diptarkaroy

Last bill was fully paid already.Bill generated ?

That's why.Last bill was fully paid already.

Let me explain:

HDFC BBPS ka Funda ye hai ki bill amount pay kar dia fir aage pay nahi kar sakte.

SBI ka ye hai ki, BBPS me last txn ke baad jitne dues honge utne pay kar sakte, isliye agar paytm me ₹1000 hi pay karne ka option aa raha but due 50000 hai to pahle 1₹ pay karna, fir 49999 tak pay karne ka option aa jaega.

Kotak me unlimited pay kar sakte baar baar.

To Yes Bank bhi HDFC ki tarah hai.

Sir ji .. ye funda pata hai. I just wanted to confirm if Yes bank is now on BBPS.That's why.

Let me explain:

HDFC BBPS ka Funda ye hai ki bill amount pay kar dia fir aage pay nahi kar sakte.

SBI ka ye hai ki, BBPS me last txn ke baad jitne dues honge utne pay kar sakte, isliye agar paytm me ₹1000 hi pay karne ka option aa raha but due 50000 hai to pahle 1₹ pay karna, fir 49999 tak pay karne ka option aa jaega.

Kotak me unlimited pay kar sakte baar baar.

To Yes Bank bhi HDFC ki tarah hai.

Yes, sir live from weeks.Sir ji .. ye funda pata hai. I just wanted to confirm if Yes bank is now on BBPS.

Hmmm … I am living under the rocks then 😁Yes, sir live from weeks.

It is fetching the bill but I have no due currently. The manner in which it is fetching by asking the RTN and 4 digits, it has to be live on BBPS 😁Hmmm … I am living under the rocks then 😁

Attachments

Similar threads

- Featured

- Question

- Replies

- 22

- Views

- 8K

- Replies

- 15

- Views

- 6K

- Replies

- 0

- Views

- 72

- Replies

- 2

- Views

- 228